DeFAI: The Fusion of AI and DeFi — Why You Should Position Yourself Before It Explodes

magine the power of decentralized finance (DeFi) combined with the intelligence of artificial agents. This groundbreaking synergy, coined as DeFAI (Decentralized Finance + Artificial Intelligence), aims to simplify DeFi while maximizing profitability. As highlighted in The Defi Edge's tweet, DeFAI could revolutionize financial autonomy and become a multi-billion-dollar industry. Early adopters have a golden opportunity to position themselves before this narrative explodes.

Why Be Bullish on DeFAI?

1. Abstraction: Simplifying Complexity

DeFi's interfaces often overwhelm new users with complexity. DeFAI solves this by enabling natural language interactions, allowing users to issue commands like "Swap 2 ETH for USDC" without navigating intricate UI/UX systems.

2. Enhanced User Profitability

Automated trading, yield optimization, and reduced human error are key benefits. DeFAI agents can execute sophisticated strategies to maximize returns, eliminating common mistakes in manual operations.

3. High Revenue Potential

Like tools such as Bananagun and Photon, DeFAI agents offer immense revenue potential. These protocols generate significant fees, and DeFAI's unique tokenomics could enhance long-term profitability.

Three Key Use Cases of DeFAI

1. AI-Driven Interfaces for DeFi

Executing DeFi transactions involves multiple steps and risks. An AI-powered interface simplifies this with commands such as "Add liquidity to ETH-USDC pool" while ensuring security and accuracy. This reduces barriers for newcomers and boosts adoption.

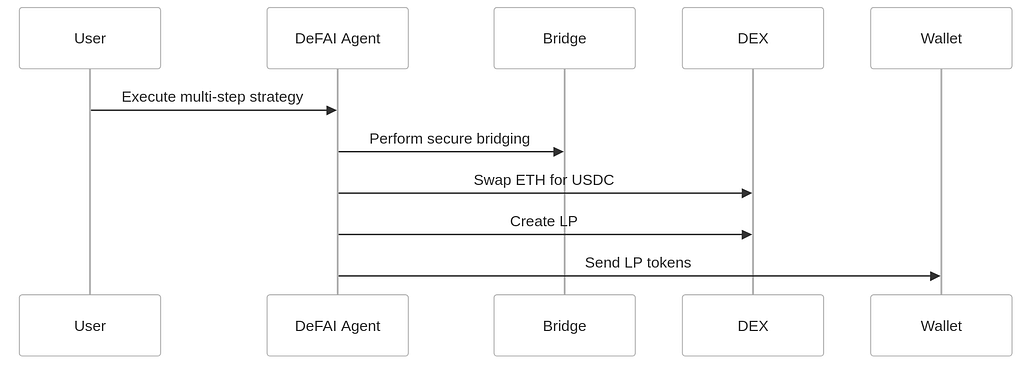

2. Autonomous Transaction Execution

DeFAI agents execute complex multi-step strategies autonomously. For example, you could instruct an agent:

"Bridge ETH to Base, swap half for USDC, create a Uniswap LP, and send LP tokens back."

The agent handles bridging, swapping, creating liquidity pools, and sending tokens seamlessly. This automation transforms DeFi operations into simple user prompts.

3. Research & Communication Agents

These agents save hours of research by analyzing whitepapers, governance forums, and on-chain data. You could ask, "What's the best yield strategy for my portfolio?" and receive optimized insights based on your holdings and risk tolerance.

Top DeFAI Projects to Watch

With Tokens

- Griffain

• Market Cap: $494M

• Key Feature: Allows users to execute on-chain actions via natural language commands. - Hey Anon

• Market Cap: $172M

• Focus: Natural language transaction interfaces and DeFi research agents. Funded by DWFlabs with $20M. - Orbit

• Market Cap: $43M

• Supports 100+ chains and simplifies cross-chain transactions with AI agents.

Without Tokens

- Cod3x

No-code platform for building DeFi agents with advanced strategies. - Almanak

Institutional-grade tools for autonomous financial agents. - WayFinder Protocol

Deploys AI agents for DeFi tasks with a single text command.

Early Risks and Rewards

It's crucial to note that DeFAI is in its early stages, which means higher risk but also greater potential rewards. Many protocols are still in beta, and execution risks exist. As Daniele Sesta notes, this phase offers significant opportunities for those willing to take calculated risks.

Conclusion: Seize the DeFAI Opportunity

DeFAI represents the next evolution in DeFi, poised to lower barriers and enhance financial freedom. Whether you're a crypto veteran or a newcomer, this sector offers a transformative way to engage with decentralized finance. Stay informed, create your watchlist, and position yourself early to capitalize on this emerging trend.

Liked this article? Share your thoughts in the comments and let's discuss the future of DeFAI!

source: https://raglup.medium.com/defai-the-fusion-of-ai-and-defi-why-you-should-position-yourself-before-it-explodes-ae17bf8732b8?source=rss-f56f44caad34------2

Comments